Q – We’re sitting here reading the Viking brochure we had to download because our agent didn’t have any. We’ve asked about insurance and she told us that Viking has a cancel for any reason policy since we took out their insurance at the same time we just made our deposit. Did we make a mistake? I am sure that a lot of people who come to this site have insurance questions so anything you could explain in plain English would really be appreciated.

Q – We’re sitting here reading the Viking brochure we had to download because our agent didn’t have any. We’ve asked about insurance and she told us that Viking has a cancel for any reason policy since we took out their insurance at the same time we just made our deposit. Did we make a mistake? I am sure that a lot of people who come to this site have insurance questions so anything you could explain in plain English would really be appreciated.

A – River cruise line insurance is generally sold atf 8-10% of the total trip cost. It is flat-rate insurance so the premium is an average cost of all coverage. That means it is not age-based so if you are in your fifties, you are paying a premium influenced by the insurance cost of guests in their eighties.

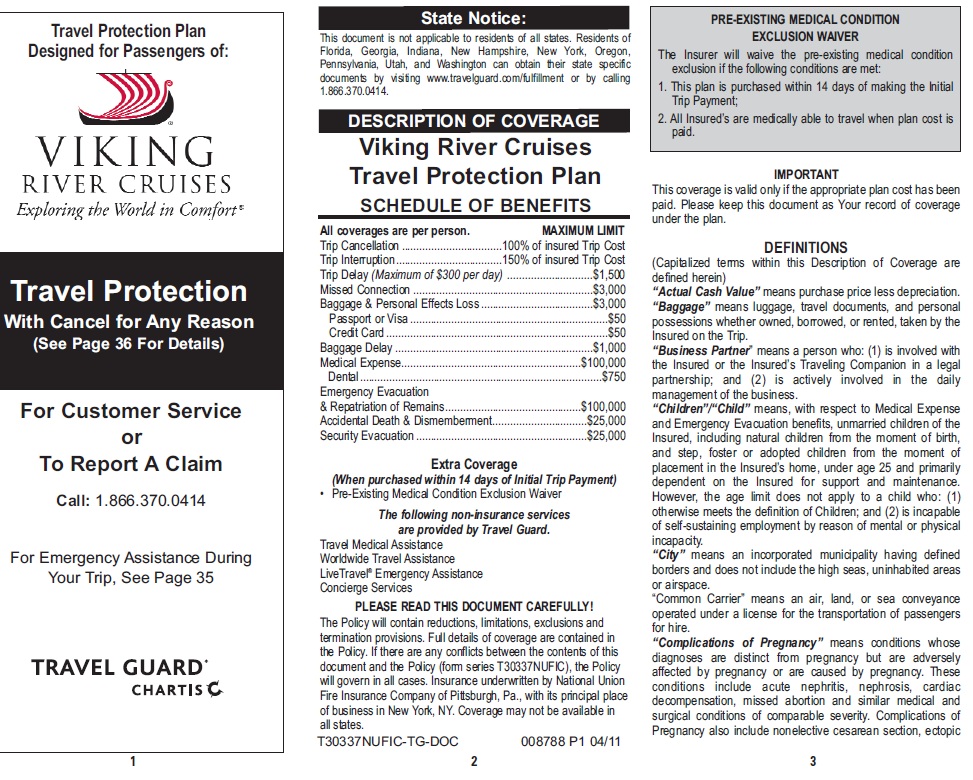

Viking River’s cancel for any reason policy means that if you take out the policy within 14 days of giving your TA your deposit, you can essentially cancel your cruise for any reason. The penalty of your cancellation will still be charged but you will receive a voucher for the cancellation fee amount – and here’s the tricky part so get ready – in the form of a voucher for a future Viking trip with date restrictions etc. You are not getting cash only a voucher for a future trip with Viking.

This is underwritten by Viking and has nothing to do with its normal insurance benefits which are unwritten by Arch Company, in Jersey City, New Jersey. The plan is administered by Trip Mate, which is headquartered in Kansas City. They are a prominent insurance agency in the travel field.

But there are other rules and some exceptions based on state law. The point to remember is that your travel consultant should be able to knowledgeably recommend the best insurance based on your specific age and health profile. If your agent is not well versed on this subject look for someone who is. This is much more important than selling you a trip.

There are a lot of online shills in chat rooms promoting online insurance brokers who supposedly compare all sorts of policies to find the cheapest. That is a sucker bet. In fact, you generally should not purchase anything but one of the more expensive policies available. What we look for is the medical evacuation provision. In general you want at least $200,000 worth of coverage. Accidental death and dismemberment should be adequate, look for at least $100,000 of coverage.

Finally, what no one ever tells you is that many of the top consultants sell so much travel insurance that they have an ongoing personal relationship with the insurance company and its claim adjusters. Work with someone who can make that call. We feel that Viking’s coverage is inadequate but we don’t know your age or medical profile so our opinion as to the wisdom of your purchase is not really important. There are hundreds (not thousands) of top-tier river boat consultants in the United States perfectly capable of providing the level of counseling the smart consumer really needs. If you don’t have one, find one. Insurance is a very serious subject.